The Best Marketing Ideas for Medicare Insurance Agents in 2023

Discover an efficient and effective marketing strategy that will gain you not only more repeat business but also increase your client referrals.

As a Medicare insurance agent, you’ve got a large number of balls to keep in the air, including annual education and license requirements, ever-changing marketing rules and regs, and a clampdown on failures to record sales calls. Drop even one ball, and you could find yourself facing hefty fines, the loss of your license, and even jail time.

These erratically moving balls make marketing Medicare insurance different from marketing other types of insurance. As a result, a great deal of what passes for “marketing ideas for insurance agents” simply doesn’t apply to you—and that makes finding new business to write a constant challenge.

A lot of what passes for “marketing ideas for insurance agents” simply doesn’t apply to Medicare agents, which makes finding new business a constant challenge.

Of course, repeat business is essential; it’s the bedrock of any successful business. But as you know, after the initial policy year, Medicare agents are only compensated half as much for every retained client. Still, retained clients are valuable for the additional business they can bring to you in the form of referrals.

In this blog post, I explain what relationship marketing is and how to implement it in ways that avoid the dangers of violating CMS marketing regulations—all while keeping you top of mind, making you unforgettable, and winning you more repeat business and client referrals.

What is relationship marketing, and why is it the best fit for Medicare insurance agents?

While the pressures on Medicare agents and their ability to market benefits to prospects are unique, there is a piece of universal advice you should heed:

The opportunity for independent insurance agents and brokers in all niches is where it has always been, only now it’s more important than ever: build authentic relationships with your clients.

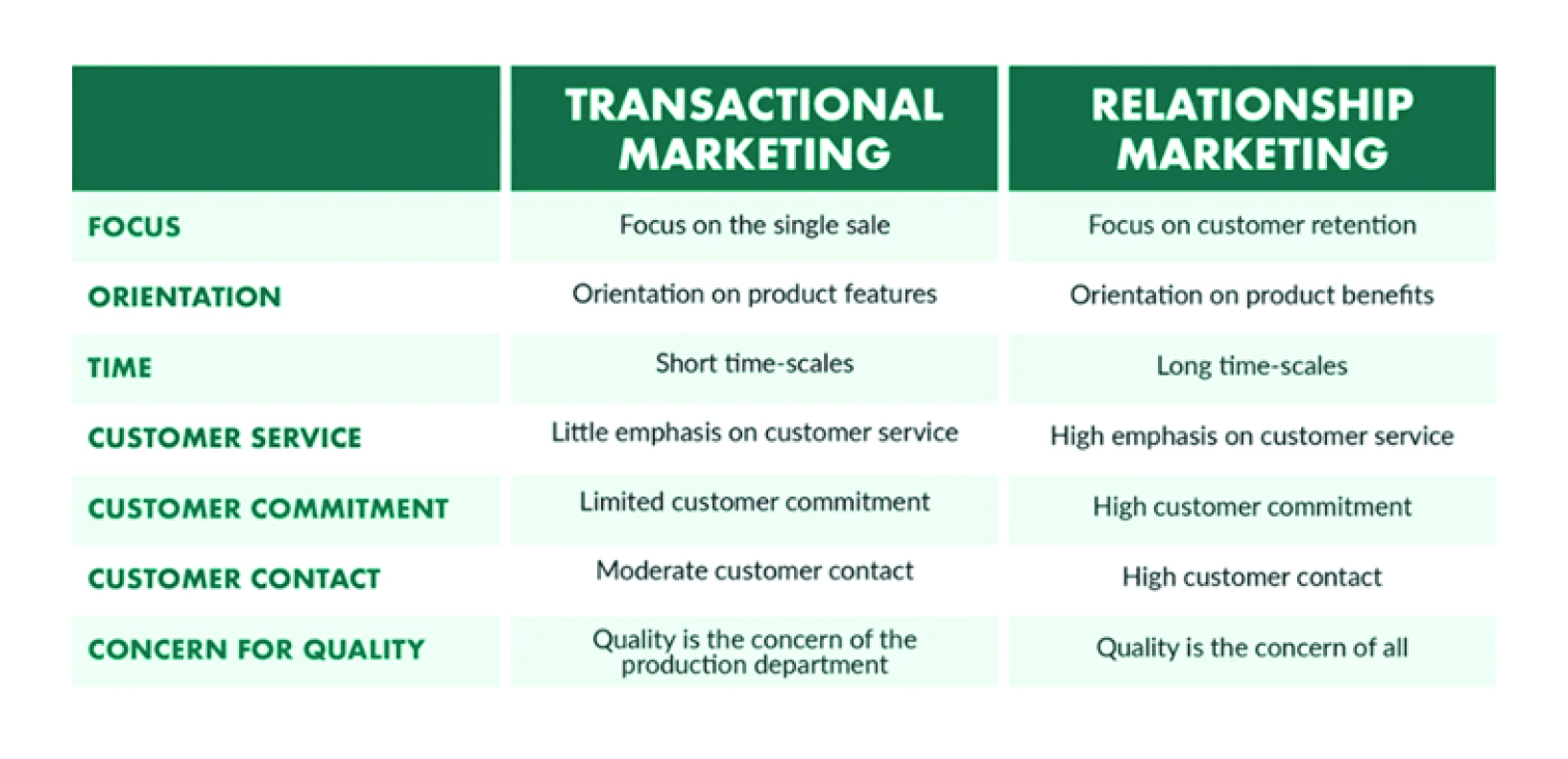

To define relationship marketing, it’s important to first understand that it’s a distinct strategy for building life-long relationships with clients and customers. It’s not a short-term, hit-it-and-quit-it approach to making the next sale.

Rather than focus solely on the next transaction, relationship marketing focuses on the long game, promoting customer retention by providing value as well as enhancing and ensuring customer satisfaction and loyalty. Strong customer relationships are monetized by an increase in clients’ lifetime value, referrals, and word-of-mouth promotion.

For the Medicare agent, relationship marketing is a no-hassle, compliance-friendly, and profitable approach to retaining Medicare Advantage clients and securing new business through client referrals. It’s a perfect fit for the independent producer precisely because its emphasis is on building bonds with those you serve. Rather than focus on the immediate transaction, it’s a collection of systematized steps you take to nurture relationships outside the parameters of the Medicare annual enrollment period.

How relationship marketing works

A pervasive problem for independent insurance agents, whether they sell Medicare or other insurance, is being forgotten. Insurance clients can readily tell their friends and family who their carriers are, but rarely they can tell them the name of the producer who sold them their policies.

An effective relationship marketing strategy solves this problem by keeping you frequently in front of your database of contacts without making them feel like you’re stalking them. Done well, relationship marketing creates extensive brand awareness, but it also breeds familiarity. Why be concerned with familiarity? Because it helps to build and strengthen the necessary trust between you and your current and prospective clients.

But frequent and consistent contact, while necessary, isn’t sufficient. To become unforgettable, your marketing also needs to make an impact. Case in point: you can give clients pens with your contact info stamped on the side, but does that really help distinguish you from your competition in a way that makes you memorable? Is someone going to rummage through their junk drawer to find that pen and give your name to a friend? Uh, no.

If you want to be unforgettable, then your marketing needs to be frequent, make an impact, and build trust. It needs to be F.I.T.

It’s got to be frequent

How frequent do your customer touchpoints need to be? It’s a question we often receive, and it’s one to which different marketers will give different answers. Too many customer touchpoints with the same message using the same channel, and your audience becomes immune. Too few touchpoints, and you run the risk of your clients forgetting you.

Because relationship marketing is primarily concerned with building long-lasting relationships among your Medicare clients rather than pitching plans during open enrollment, you can think about frequency in a way that is more meaningful. Instead of simply asking, “How many touches does it take to close a deal?” (research averages that number around eight), ask, “How often should I be in touch with my clients to create an authentic connection?”

If someone only reached out to you once a year, you’d be hesitant to call that person a friend. Even calling them an acquaintance might be a push. But if someone consistently engaged with you six or seven times a year to ask how you’re doing, catch up, and offer help when needed, you’d appreciate the effort and remember them.

It’s got to make an impact

Impact is created when your marketing is personalized and delivers value.

Personalizing your marketing goes beyond including their name in an email subject line; it’s about treating your clients as individuals. It’s also about sharing your authentic self and giving them the opportunity to know you as someone other than an insurance agent.

Value is delivered when you can provide people with something useful at the time they can use it. Most often, value is provided through education, entertainment, and endearing emotions.

It’s got to build trust

It’s a sad reality, but seniors are frequently at the mercy of contemptible chiselers looking to defraud and take advantage of those who don’t know they have options. Because they are so often the target of scams, it’s hard for them to know who to trust. That’s why if you’re able to earn the trust of Medicare eligible seniors, and you work to keep that trust year after year, you’ll have clients for life—and a full pipeline of referrals.

Seniors and their families appreciate an agent they can trust. Develop trust, and you’ll have clients for life as well as a willing source of referrals.

You can build trust by providing exceptional customer service on a consistent basis. You can also build trust by requesting and acting on customer feedback. Be transparent, deliver clear explanations, and take time to get to know your clients as individuals. Stand apart by getting to know your clients’ families as well, since older children are often involved in their parents’ care.

Next, let’s talk about how Medicare insurance agents can implement a relationship marketing strategy that is not only F.I.T. but also avoids running afoul of Medicare regulations.

Creative ways Medicare agents can build relationships with clients all year round

1. Use social media

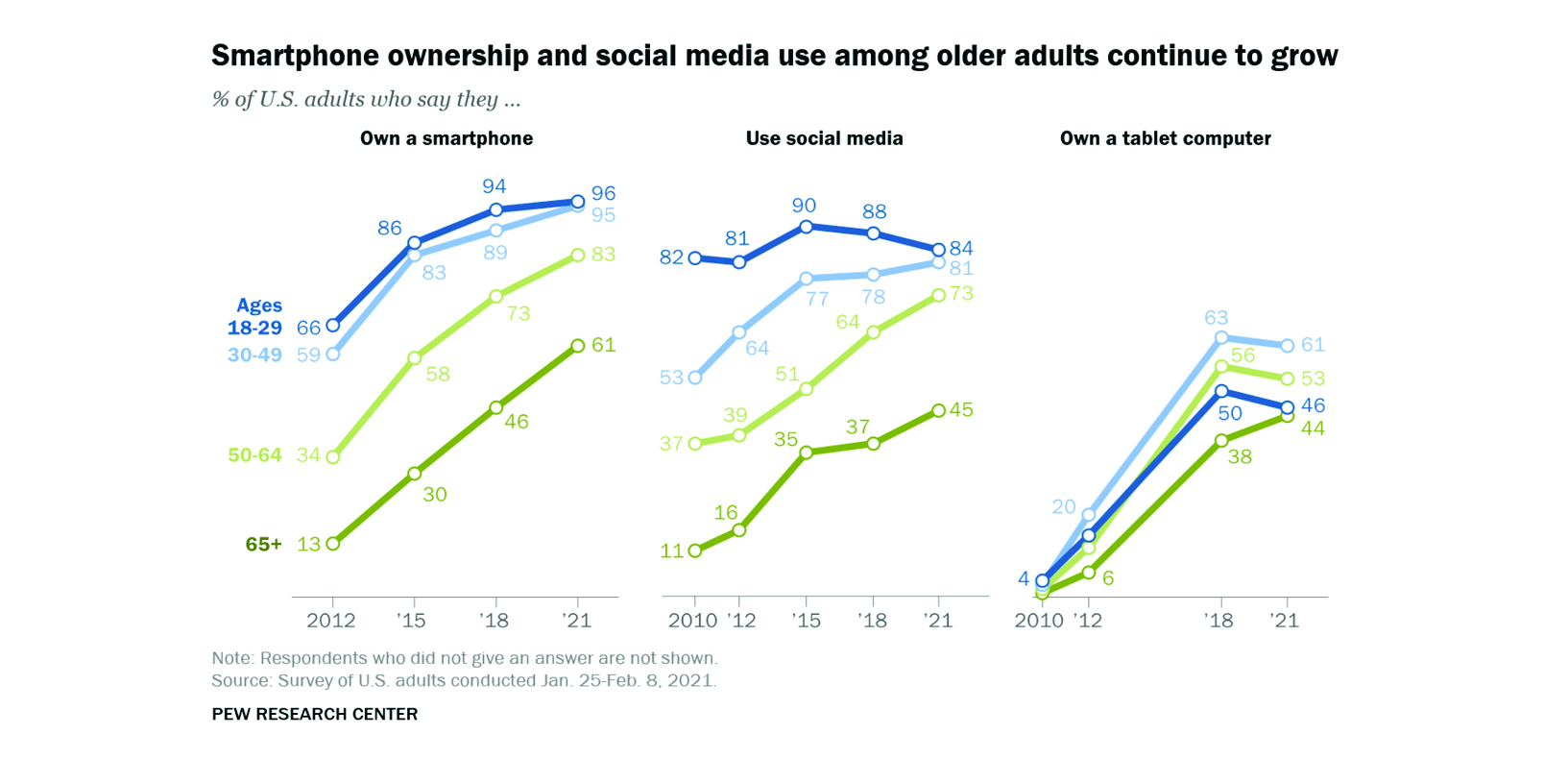

Early in 2022, the Pew Research Center published its findings about the use of social media, smartphones, and other technologies across generations. Among those 65 and older, 45% reported using social media—a fourfold increase since 2010. Additionally, while virtually all respondents (99%) between the ages of 18 and 29 reported routinely using the internet, among people 65 and older, the number is 75%. That’s a significant gap, but it’s a gap 32% smaller than it was two decades ago.

Clearly, seniors are becoming increasingly present on social media, so it’s to your advantage to use this medium to connect with your audience.

While older adults are active on all social media platforms, if you’ want to be where your clients are most likely to be active, then look to YouTube and Facebook. Data collected in July 2022 reveals that 58% of people who are 56 years and older use YouTube while 34% of people 65 years old and more use Facebook.

Tips for connecting with seniors using YouTube

YouTube is an exceptionally effective tool that independent insurance agents in particular can use to engage with senior viewers in ways that are authentic and build trust.

You may ask, “What is authenticity in marketing?” According to NYT Licensing, “Authenticity is achieved when brands are engaging deeply with audiences, building connections that feel personal, and making their customers feel heard and understood.” And it’s in high demand—80% of baby boomers report that authenticity is important to them when deciding which brands they will support.

The demand for authentic content can be seen in the meteoric rise in popularity of user-generated content (or UGC) over brand-generated content—and that’s great news for the independent Medicare agent who isn’t bound to branding, marketing, and advertising rules like a captive agent.

User-generated content (UGC) is seen as more authentic and is desired by all audiences, including baby boomers.

Consider creating videos that tell stories important to your audience. It’s easy to create a video in which you respond to FAQs, but be sure you have videos that address more than just their insurance needs. For example, you can interview people with expertise in areas of interest to seniors, such as aging at home, the importance of staying active, and safety in the home.

Tips for connecting with seniors using Facebook

Connect with clients who use Facebook by sending them friend requests. Ask them to follow you, and return the favor by following them.

Post pictures of your personal life, like family vacations, birthday parties, holiday gatherings, date nights, walks in the park, and pets. Tag specific clients when you post something of interest to them, letting them know you remember details they’ve shared with you. (This is where a detailed client database is especially helpful.)

Share aspects of your life outside of work with clients. You’ll be more relatable and likeable, which are key requirements for building trust.

In a similar fashion, when you see a client post about a life event, such as the birth of a grandchild, a graduation, or a milestone birthday, don’t just like it—be sure to post a comment as well. More than a quick like, a comment demonstrates a deeper level of care and commitment to the relationship.

Gestures like these may seem small and simple, and you might doubt they’d have much impact on building a trusting relationship with your senior clients, but they can mean the world to an older adult who doesn’t use social media in the same ways that younger people do.

In addition to reaching out to specific individuals, you can also post information that seniors will generally find entertaining. Inspirational quotes, quizzes, best-of lists, relevant news stories, funny memes, notices of activities designed for seniors, special deals, and curated photos and memories of decades gone by are just a few examples. Simply ensure that you understand your audience (what younger users enjoy may not be what older generations enjoy), and then put your imagination to work.

If you’d like more ideas for using social media, many of which you can adapt to a Medicare audience, then check out 11 Wildly Effective Social Media Marketing Ideas for Insurance Agents.

2. Use text messages

The Pew Research Center report also notes that just like more seniors are using social media than ever before, the percentage of people 65 and older who own a smartphone is steadily increasing, up to 61% in 2021 from 13% in 2013.

Set a schedule to send a personal text message to five clients each day for five days. At the end of a month, you’ll have reached out to 100 clients. Do this once a quarter, and you’ll succeed in developing consistent contact that will keep you top of mind.

Remember that these messages are meant to help you build relationships; they are not tactics for selling. Explain that you were thinking of them and wanted to check in to see how things were going, and ask if they need anything. Consult your database for any notes that might give you a special reason to reach out.

3. Use direct mail

For all our sophisticated communication technologies, a handwritten note still makes us feel special. You only need to reflect on the last time you received such a note in the mail to know what I mean. I’m willing to bet it was the first piece of mail you opened that day, and you may even have kept that card or letter in a drawer or a special box.

A handwritten notes sent via US mail is one of the least expensive and most effective ways to make an impact on clients.

Give your clients that same feeling by sending them a handwritten note. A birthday card is an obvious choice, but a note letting them know you appreciate their business is also appropriate. We have free thank you cards especially for insurance agents and free gift tags you can download, print, and attach to a small gift.

You’ll create the most impact when you send your clients something at unexpected times of the year. Send the pet owners in your database something for their fur babies on National Pet Day (April 11), or you can send a card to grandparents on National Grandparents Day (the first Sunday after Labor Day). National Senior Citizens Day is August 21, and May is Older Americans Month.

Be the Medicare agent who sends a card to their clients for National Grandparents Day or another day set aside to recognize seniors.

Use these and other special days dedicated to seniors to inspire your social media activity and your text messages too!

4. Share more than insurance information

We know that the value proposition of any insurance agent or broker includes their ability to serve as advisors. Especially with Medicare coverage, it’s critical to their welfare and your business to provide education to seniors and their families and help to manage expectations from year to year. But the line between “communicating” or “educating” about Medicare and “marketing” Medicare can be precariously thin and likely to be only of interest to your audience during open enrollment.

So while providing insurance information should be a significant part of your marketing strategy, to build and nurture relationships with your clients throughout the year, you can’t be about insurance all the time. The tips and ideas discussed in this blog are meant to help you stay in touch with information and content beyond your industry using a variety of channels.

How we can help

Even with this guide, coming up with a variety of content takes time, dedication, and oftentimes resources that you may simply not have.

At ReminderMedia, we help our clients overcome this challenge with a variety of products. Each product is explicitly designed to support a relationship marketing strategy with top-quality content that is delivered frequently, with impact, and in a way that builds trust. Especially pertinent to Medicare agents, our products help you stay relevant in ways outside your industry and beyond the open enrollment period.

Personally branded magazines. If you want something truly unique that delivers guaranteed impact, you might consider sending clients a free subscription to one of our personally branded magazines.

These are affordable, coffee-table quality magazines with engaging articles and beautiful images that recipients pick up again and again. Delivered automatically every two months, each magazine is branded with your image, business, and contact information in six places to ensure you’ll stay top of mind. Best of all, you can include a personal message on the Front Inside Cover customized down to the individual client at no additional cost. Click to get a free PDF of our newest issue sent to your inbox.

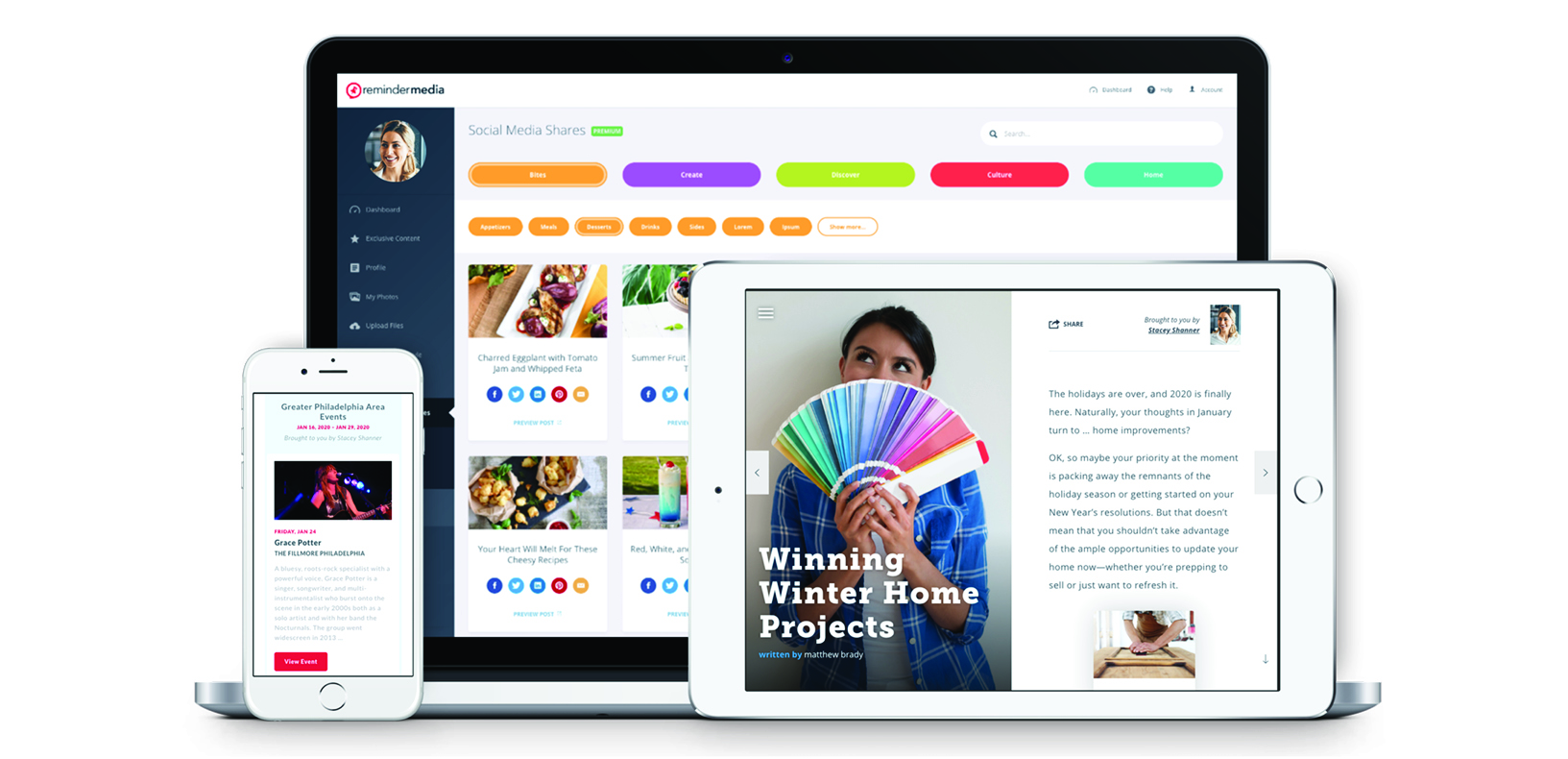

Digital marketing platform. A comprehensive and simple to use platform that’s three tools in one.

- Branded social media posts. We help our clients with their Facebook, Instagram, and other social media content by providing a large library of personally branded, prewritten posts covering a wide range of popular topics. Use our scheduling tools to plan your posts weeks in advance—a true set-it-and-forget-it solution. You can use our tools to schedule as many posts as you wish, as often as you wish. Click here and we’ll give you 30 days to try it for free!

- Branded newsletter of local and virtual events. We’ll automatically send a copy to your recipients inboxes every two weeks. Your clients can use the newsletter to plan an outing with friends, family, or caregivers or partake in enjoyable events from the comfort of their homes.

- Digital magazine. A wholly unique, interactive magazine with content that can be shared directly from within the magazine. And as is the case with all your branded products, when they are shared, your branding remains intact—giving your business a potentially limitless number of new leads.

The takeaway

Relationship marketing gives Medicare agents a way to market to their clients throughout the year without the fear of running into restrictive Medicare regulations. By focusing on building and strengthening long-term relationships with your clients rather than pitching an insurance product, you have countless opportunities to interact frequently, with impact, and in ways that build trust. With relationship marketing, you can more readily stay top of mind and efficiently generate more repeat business and increase referrals—earning you more commissions.