One of the best ways to generate insurance leads is to offer high-quality lead magnets that attract people actively interested in better understanding and meeting their insurance needs

Most insurance professionals will tell you that buying insurance leads is a viable approach to building your business for three simple reasons: it’s a way of diversifying your lead generation strategy, you can budget and manage your costs, and if you’re new to the game, you can get quick access to potential clients while gaining cold-calling experience and learning to develop a thick skin.

But purchasing leads is also notoriously inefficient—it’s a numbers game, and not one for the faint of heart. You need a lot of money to buy a lot of numbers that you’re going to spend a lot of hours dialing. In the end, you may have nothing to show for it. (No wonder such a large percentage of insurance agents fail.)

However, the fact that you’re reading this blog means you know there are other, less soul-sucking ways insurance agents can generate leads. In fact, one of the best is to offer high-quality lead magnets that attract people who are actively interested in better understanding and meeting their insurance needs.

The six insurance lead magnets below allow you to offer value to potential clients while establishing yourself as a knowledgeable and trustworthy professional. Each includes a clear call to action so leads will know to contact you for guidance when making thoughtful decisions about their needs and solutions. You can promote them on your social media platforms, in your email signature line, on your website, or in your newsletter. And if you want to advertise your lead magnet with a Facebook ad or need a high-converting landing page to capture contact information, we can help. (I’ll talk more about this in just a bit).

1. Building Wealth through Life Insurance

While many people understand that life insurance is meant to provide for their loved ones after they have died, not many recognize that it can also be a way for policyholders to build wealth. This valuable resource explains how a permanent policy can be used to supplement retirement incomes and fund loans, leave a legacy, and more.

2. Protect Your Family with the Right Life Insurance Death Benefits

With such a bold call to protect their families, concerned individuals will be compelled to request this e-book to learn more about how to ensure the well-being of those who depend on them. It explains the different types of life insurance and answers some of the most frequently asked questions. Those who consider the information in this thought-provoking document will naturally have more questions, leading them to reach out for assistance.

3. Why Employer Life Insurance Isn’t Enough

You know that when it comes to employer-provided life insurance, the terms of the contract between the employer and their insurance company may not best suit the needs of each individual employee. However, few of these people realize the limitations of their employer policies and the hazards of relying on them to care for their families. This resource provokes readers to think about what they may be risking, and once they do, you can be sure they’ll reach out to the professional who opened their eyes for assistance with purchasing an individual policy.

4. A Guide to Health Insurance for the Self-Employed

The Bureau of Labor Statistics reports that in October 2023, there were more than 16 million self-employed people in the US—a little over 10% of the population—many of whom are without adequate coverage. Because they previously relied on their employers for health insurance, these people often don’t know the alternatives available to them once they become self-employed or can easily become overwhelmed trying to find the best choice for them. With this lead magnet, potential new clients will learn about various coverage options and why seeking advice from an insurance expert (that would be you) is the best way to help determine which may meet their needs and budget.

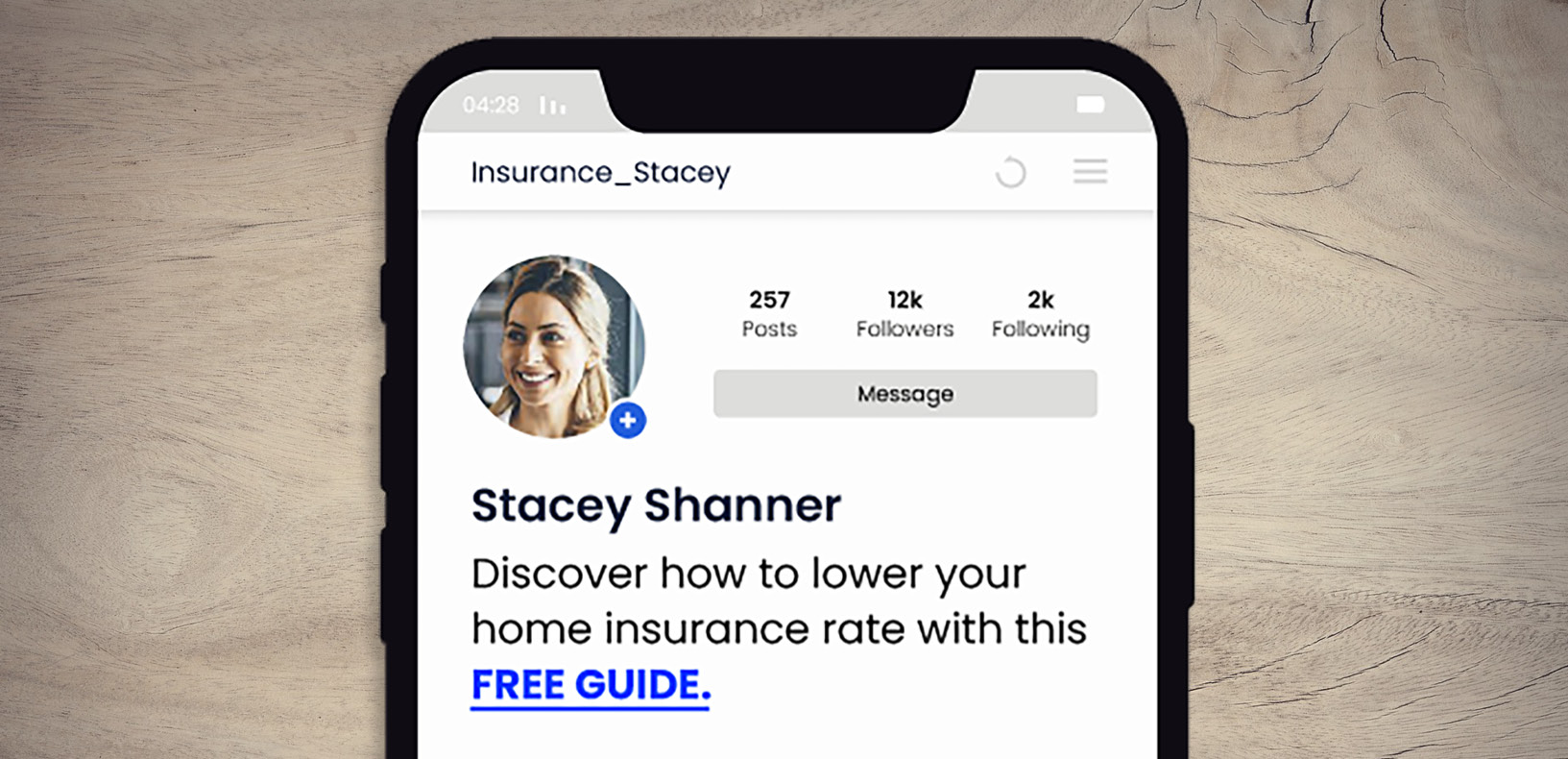

5. How to Get the Best Rate on Home Insurance

Insurance is something homeowners buy to help protect them financially in case they run across a costly issue. It becomes painfully ironic, then, when they wind up paying an unnecessarily high price for the policy itself. For this reason, a free resource that offers them ways to reduce their insurance costs may be irresistible. Use this lead magnet to attract potential clients and encourage them to contact a specialist like yourself who is experienced in the terms, conditions, and exclusions that can make finding the right policy a wearisome and difficult process for homeowners to navigate alone.

6. 11 Ways to Lower Your Homeowners Insurance Rate

Many homeowners, especially first-timers, purchase home insurance not realizing that there are things they can do—before and after buying a policy—to help keep and perhaps even lower the cost of their coverage. Offer this free lead magnet full of tips on how to do so. For instance, sharing some key information with their insurance company, such as measures they’ve taken to increase security or the distance to the nearest fire station, may result in premium savings. And if they’re still not satisfied, they can reach out for expert guidance on getting coverage they need at a price they can afford.

Ideas for promoting your lead magnet

When attempting to attract leads, creating a lead magnet is only step one. Just as important are the actions you take to promote it. To give your lead magnets the widest exposure, use as many of the following suggestions as you are able.

Organic promotion

On your website, you can add a promotional banner, integrate a promotional pop-up, include your lead magnet on a resource page, or feature it in a blog post. On social media, you can write posts to promote it, pin your most popular post to the top of your feed, update your social media banners to draw attention to it, or add it to your bios.

Paid promotion

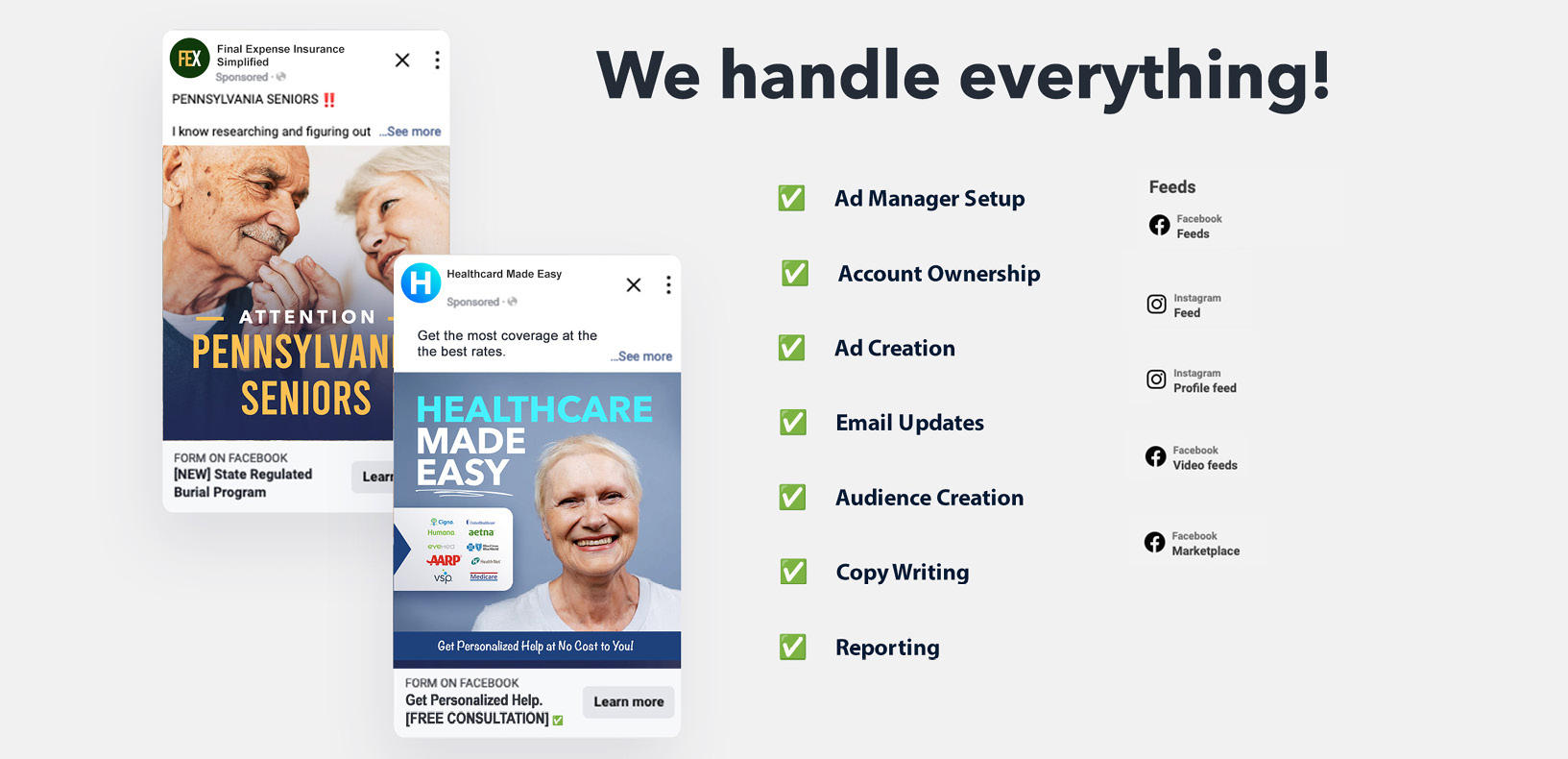

Let our team of Facebook ad experts do all the heavy lifting and create campaigns for your insurance business that attracts leads effortlessly.

While it takes time for organic promotions to pick up steam, paid promotions like pay-per-click ads give you more immediate access to your target audience. Our clients enjoy the ease and convenience of letting us design and run their Facebook ad campaigns for them. We’ll set up your account, run our highest-performing ads written and designed by our Facebook gurus, feed all the important metrics to your dashboard, and set up notifications so you know exactly when you’ve got a new lead.

Your lead magnets can perform double duty when you send them to current clients—they’re a way to continue adding value and strengthening the relationships you already have. Promote them in your email newsletter, add the link to your email signature, or include it in your thank-you emails.

Capture leads with a high-converting landing page

Once someone clicks on your lead magnet, they need to arrive at a high-converting landing page that makes it super easy for them to provide you with their contact information. If it’s confusing in any way, your potential new client may never take the next step and enter your sales funnel, defeating the entire purpose of offering a lead magnet in the first place.

As simple as a landing page may appear, there’s a good deal of skill and creativity that goes into writing and designing one that is effective. A well-crafted landing page will:

- Be responsive and adapt to viewing on mobile devices.

- Have a headline that includes a benefit.

- Include an image of your offering.

- Feature text that is brief and persuasive.

- Showcase one highly visible call to action.

- Place your form where it can be seen without scrolling.

- Be free of all navigation.

- Ask only for the information you need.

- Trigger a thank-you page once the information is submitted.

Of course, once your page is live, you’ll want to know how it’s performing. To do that, you need a way to measure and track some key metrics that can point you toward what may need to be adjusted. Be sure you know:

- How many people are visiting your page

- Where traffic is coming from

- How many visitors arrive and then immediately leave

- What people read and engage with

- How many completed the form

- How many start to fill it out and then abandon the effort

- How many new contacts you captured

Landing pages made easy

Eliminate the worry and hassle of creating landing pages and tracking performance with our high-converting landing pages. Click to learn more.

The know-how and time required to create tools like landing pages are things most insurance professionals don’t have, nor should they be expected to. Your job is to help your clients; our job at ReminderMedia is to help you do just that.

When our clients came to us for help with their digital marketing campaigns, we conducted extensive research to identify all the qualities that create the best high-converting landing pages. Then we put our creative and technical teams to work. The result is a series of customizable landing pages tested and proven to produce results, which we’ve include as one of the four tools in our Digital Marketing Platform.

These landing pages are noteworthy for several reasons. We will personalize each with your theme, branding, photo, and contact information and provide you with consistently refreshed analytics you can view anytime by visiting your dashboard. And because we understand that speed to lead is a critical factor in getting an appointment, we will notify you as soon as someone completes a form and automatically add them to your list of new contacts.

Take the next step

Download and use our free lead magnets to attract more warm leads and build your list of contacts. You can also visit our Resource Library for more free tools and information, including e-books, that will help you grow your business.

Apple Podcasts

Apple Podcasts

Google Play

Google Play

Spotify

Spotify