Updated May 5, 2021

There is no shortage of advice available to financial advisors and broker-dealers about how to market their businesses. I’ve seen advice ranging from sending birthday and holiday cards to hiring a marketing firm or consultant whose expertise is working with financial services professionals.

But if you’re a new advisor who’s only recently made the transition from a representative at a broker-dealer or wirehouse to being an RIA, then you likely have a significant problem shared by many new entrepreneurs:

Your time is precious and largely invested in running your business,

and you have little cash flow,

but you still need to find clients.

If this is you, then not only do you need a marketing plan that works, but also one that is efficient and cost-effective.

And while every marketing plan should include a variety of tactics, which ones best address the specific needs of newly independent financial advisors? Which plan will help you get more clients in ways that save you time (is efficient) and produce qualified leads whose cost of acquisition is reasonable (is cost-effective)?

I’ll get to what the data recommends as the best way for independent RIAs to market themselves and get more clients.

But first, I want to discuss what independent advisors and small firms typically do to find clients, and whether it’s as efficient and cost-effective as some might believe.

Then, because you’ll want variety in your marketing plan, I want to measure some additional often-recommended tactical efforts against the same criteria.

Advisors’ “time cost” as a substitute for marketing budgets

Michael Kitces is a reputable, certified financial planner who authors the Nerd’s Eye View blog and The Kitces Report, a series of research studies for and about the financial industry. He also hosts the Financial Advisor Success podcast.

In 2019, Kitces’ team surveyed 800 advisors and discovered that the typical financial advisor spends roughly 50% of their time on direct client-related tasks, and scarcely 20% of their time meeting with clients. These advisors spent as much time prospecting for qualified leads and marketing for new clients as they did meeting with all their existing clients week over week. And this trend is only slightly altered by the rise in recurring-revenue fee-based models.

For the new RIA without sufficient funds, sweat equity may seem like an attractive alternative to shelling out precious funds. But don’t forget—time is money. So how much money are we talking about if what you’re spending is your time?

According to the same Kitces Report, the average cost to acquire one new financial client was $3,119, of which 83% or $2,600 was the “time cost” of the financial advisor. Only $519 in actual dollars was spent on marketing costs.

Your time has monetary value. Don’t burn through your day on activities that aren’t making you money.

Plus, you might want to ask what is the opportunity cost for using your time as a substitute for a marketing budget. One such cost would be the higher fees you could charge for better serving existing clients.

As a marketing tactic measured against efficiency and cost-effectiveness, you need a better way to promote your business than using your time as a substitute for a marketing budget.

Let’s look at other options.

Additional options for marketing your RIA business

Inbound and outbound marketing are two broad categories of marketing plans.

Inbound marketing draws potential prospects in by creating valuable content that answers their questions and solves their problems so that when it comes time to buy a product or service, they initiate the conversation by coming to you. Inbound marketing includes tactics like content marketing (blogging), social media campaigns (posting on Facebook and similar social media platforms), SEO (search engine optimization), e-books, videos, and websites.

If you would like a FREE copy of this e-book click here.

Outbound marketing is what you might think of as more traditional marketing—television and radio commercials, print advertisements like brochures and direct mail, email, event marketing like seminars and conferences, and cold calls. It’s used when a brand pushes its message out to the masses, hoping it captures the attention and interest of the prospects they want to attract.

Cold calling can be a winning marketing strategy. Crush your calls with the advice in this free e-book.

Both types of marketing have their place in a well-rounded marketing plan. But which tactics within their respective types of marketing are efficient and cost-effective for new independent RIAs?

Inbound marketing: SEO

SEO is the process of refining your website and other online content so that search engines like Google will show your content at the top of its search results for certain words or phrases.

For example, if I use Google to search “independent RIA retirement planning,” and you are an independent RIA who offers retirement planning services, you want to be as high on Google’s list of search results as possible. Here’s why:

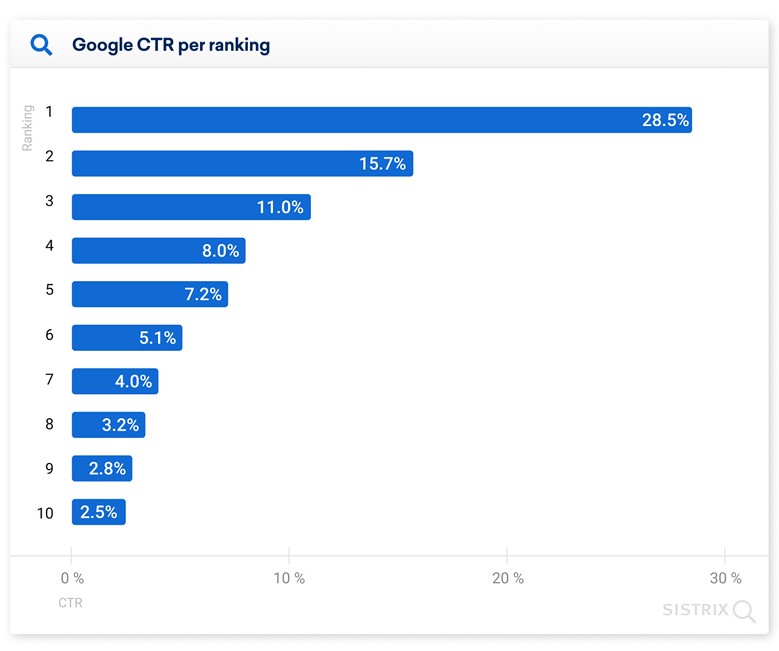

- The first three results on page one of a Google search get 55% of the clicks. [Source]

- The tenth result on page one only gets 2.5% of clicks. [Source]

- Regardless of position, results on page two have less than a 1% chance of getting a click. [Source]

Where’s the best place to hide a dead body? Page 2 of Google. Image credit

Inbound marketing is largely, maybe exclusively, digital in nature. And because Internet searching is ubiquitous, and high Google rankings (or any search engine ranking for that matter) are so critical, it almost doesn’t matter if SEO is efficient or cost-effective . . . you need it.

No ranking, no clicks. No clicks, no prospects. No prospects, no clients.

Even so, SEO can be more or less efficient and more or less cost-effective.

You can certainly learn SEO yourself, but to do it correctly so that it produces the desired results is a complicated task. You’d likely spend weeks trying to do what a professional trained in SEO can do in a much shorter period of time.

If it’s a question between spending your time or your money, ask yourself, “Is my time better spent doing something else?”

As for cost, the range is wide because of the professional’s experience, what services you purchase, the scale of the project, and their pricing model.

Matt Diggity, founder of Diggity Marketing and a veteran of the industry, recommends that the “sweet spot” for small business SEO is between $2,000 and $2,500 a month. And he reports businesses that spend more than $500 a month are “extremely or very satisfied” than those who spend less.

For SEO, the verdict is clear: as a new RIA, your marketing plan should include SEO. It’s more efficient and cost-effective to hire a professional than to either not engage in SEO or to do it yourself.

Unless you’re your own expert, it’s more efficient and cost-effective to hire a professional to do your SEO.

Outbound marketing: Webinars

Prior to the pandemic, hosting an educational seminar or other organized professional event gave you the opportunity to meet prospects face-to-face and shake a few hands. You could display your expertise and authority, earn points in the credibility column, and provide your audience with collateral to take home.

Now, instead of in-person events, we have a plethora of virtual events: virtual conferences, virtual trade shows, virtual career fairs, virtual exhibitions, virtual town hall meetings.

This is the new normal.

The good news is, with some practice, you can still accomplish with a virtual event much of what you could with an in-person event and at a substantially lower cost.

In-person events may come back but, for now, virtual events keep everyone safe, reduce your costs, and still provide benefits.

Back in the day, you would need to pay to rent a space for an in-person event.

You’d likely provide drinks and hors d’oeuvres or possibly dinner.

You might consider door prizes.

And you’d undoubtedly invite clients to bring their spouse or friends.

For a new RIA in a pre-COVID-19 world, that expense would take a big bite out of your budget.

Virtual events, on the other hand, don’t require you to rent a space or to feed people. You can use one of the many virtual meeting platforms available and, depending on your needs, there may be a free version that will work fine. (If not, ask for a demo before you commit.) There are also companies that specialize in hosting educational webinars for financial advisors.

For the new RIA just getting their feet wet, I recommend an educational webinar using Facebook Live. It’s free, easy to use, and with the right Facebook lead ad, your audience of potential clients could be sizable. And because your recorded session can be shared, you can get in front of even more people.

The sum total of your preparation for a 50-minute session could be as little as two or three hours. (Be sure your topic is something you know well and that your target audience wants to hear about.) A one-time task to put an outline together combined with a few run-throughs, and you’re done.

And since Facebook Live is free to use, it’s absolutely cost-effective, which is important because using Facebook Live to get more clients is a numbers game.

Win or lose, a Facebook Live session costs you no more and no less than nothing. But the more times you host a session, and the more people who participate, the more likely you are to find a group of prospects who may produce a client.

The best marketing tactic for independent RIAs

For his detailed study, Kitces evaluated 25 marketing tactics, including SEO and educational tactics like webinars, against their efficiency, cost-effectiveness, and cost-efficiency.*

SEO and providing education ranked well, but even among advisors who most struggle with their marketing, client referrals ranked number one.

[C]lient referrals gravitate all the way to the top when viewed from an efficiency perspective, as not only are client referrals relatively time- and cost-efficient (at least at the margin, given the time already invested into the client relationship), but they also tend to produce a high quality of leads.

But what Kitces doesn’t mention is the best way to go about getting those referrals . . . that’s where we come in.

How to garner effective referrals

Collecting referrals isn’t only a matter of asking for them—just ask Dan Allison.

Dan is a clinical and behavioral psychologist, president, and managing partner of Brokers Clearing House, LTD. He works with investment and insurance professionals to overcome the mental and other barriers clients have when it comes to providing effective referrals.

At ReminderMedia, we help professionals like independent RIAs and other entrepreneurs overcome barriers to referrals with a four-point marketing strategy:

- Create consistency: When you are in consistent contact with your clients and their families, you become familiar. Familiarity is the key to being known, liked, and trusted.

- Have an impact: To have an impact, your marketing needs to be relevant to your audience. It needs to be timely, useful, and entertaining. If it’s not, you and your marketing will be ignored.

- Build a brand: Your brand needs to be associated with the trust and expertise you build as the SME in your niche.

- Be memorable: Above all, you need to be visible everywhere and all the time. You need tools to keep your name top-of-mind.

If you want more client referrals—the #1 proven way to convert leads to clients effectively and efficiently—then let us help.

Check out our entire suite of products and request a free PDF sample of any of our four, best-in-class publications. Each issue is mailed to your exclusive list of contacts [no one else can mail to the same address] and like all our products, they are automated and personally brand to you. Check us out.

* To determine whether a marketing tactic is cost-efficient, Kitces compared the revenue generated from a client to the cost of acquiring the client. You can think about the difference between cost-effective and cost-efficient this way: Something can be cost-effective (the money spent brought about a desired result) but may not be cost-efficient (the amount of money wasted was more than the value of the desired result). The opposite is also true.

Apple Podcasts

Apple Podcasts

Google Play

Google Play

Spotify

Spotify