Among the available marketing strategies for financial advisors, social media is fast becoming a way for independent broker-dealers and registered investment advisors to level the playing field and grow their practices

In the increasingly competitive world of expert financial services, the role of marketing has taken on new significance. While traditional marketing methods still have their place, they are being increasingly complemented or replaced by digital strategies, including social media marketing strategies, that offer a broader reach, better targeting, and more measurable results.

Independent broker-dealers (IBDs) and independent registered investment advisors (RIAs) who compete with much larger firms with much deeper pockets in particular are turning to social media as a tool they can use to level the playing field and foster growth in their practices.

Why financial professionals should use social media

Perhaps the most obvious reason why you should utilize social media as a financial professional is because it gives you an economical and efficient way to introduce yourself and your brand to prospects you otherwise would never reach.

Social media is an economical and efficient way financial professionals can introduce themselves and their brands to prospects they may otherwise never reach.

According to Statista, there are more than 308 million social media users in the United States, a number that is only projected to keep growing. Of course, not all of those people are potential clients, but here’s something interesting—per a 2023 joint report from the FINRA Investor Education Foundation and the CFA Institute, 48% of Gen Zers turn to social media for investment advice rather than to a financial planner. Another survey, this one commissioned by Forbes Advisor, found that among millennial and Gen Z Americans, 79% have gotten financial advice from social media.

While these percentages may seem high, they’re not surprising. What they do demonstrate, though, is how important it is for every financial advisor to make social media a key aspect of their marketing strategy—especially given how the historic transfer of wealth already under way is rapidly growing a younger client base that is already accustomed to using the tool. In fact, results of one 2023 survey indicate that 94% of financial advisors are using social media for business (although how they use it and to what result varies widely), while another suggests that nearly 19% think it will be their most important marketing strategy.

So let’s review some of the best content for financial advisors to post and promote.

Educational content

It’s no surprise that educational content makes for great social media posts. Prospects are looking for experts who can help them with their financial needs, and what better way to establish your qualifications than by providing content that keeps them well-informed and answers their most pressing questions?

Blogs and articles

Blogs and articles are an opportunity to provide value while demonstrating your knowledge and expertise.

Blogs and articles allow you to cover a topic in depth. A thorough discussion of a subject, complete with reputable research, will demonstrate your knowledge and expertise. This type of content is also ripe for repurposing, meaning you can present the same information in a variety of formats for a variety of purposes. You may not have the luxury of time to write a blog, but if you do, share relevant content and integrate it with your social media. Be sure to include an enticing headline and a brief summary to encourage clicks.

Infographics

There are many online resources to help you easily design infographics, which are ideal for communicating complex financial concepts.

Infographics are ideal for presenting complex financial concepts, especially numbers, processes, comparisons, and hierarchies. They are processed more easily than words—allowing your audience to take in a lot of information at a glance—and are remembered more readily. A good infographic is infinitely shareable and will help expand your reach and, when designed with a uniform look, promote instant brand recognition.

How-to guides and tutorials

Whether they’re creating a budget spreadsheet, investing in stocks, or filing taxes, how-to guides and tutorials can provide valuable assistance to your audience. Think about their needs and preferences, and determine whether a written guide or a video tutorial will work best. (Hint: do both!)

Lead magnets

Click here to download this free lead magnet. Use it to attract potential new clients.

A lead magnet is a free item of value that a prospect is willing to provide their contact information to receive (typically as a download or in an email). Determining what your audience considers valuable is a matter of understanding your ideal client’s needs and desires—a prospect close to retirement age will have different pain points than one who is just starting their career. Check out the selection of free lead magnets for financial professionals in our comprehensive Resource Library and offer them to your prospects to attract new leads or use them as inspiration to create your own.

Industry insights and updates

As is the case with educational content, regularly sharing updates about economic developments and what’s going on in the market will demonstrate your expertise and help foster trust. Post these reports and your interpretations to your website, then promote them on social media.

Market updates

And your analysis to market reports and regularly share them on social media. You can use these same reports in a drip email campaign.

As a routine part of your service, you likely already provide customized updates to your clients to keep them informed about market conditions and help them make educated investment decisions. You can do the same for prospective clients by regularly posting more general reports, adding analyses relevant to your target audience.

Financial news

Be your audiences go-to source for important financial news when you provide a single source that allows them to keep up to date.

It may surprise you to learn that savvy content creators don’t always “create” their content. Instead, they curate what others have already provided and add their own spin to it. You can do the same by collecting links to notable financial information of interest to your ideal client, organizing them in a fashion similar to a newsletter, adding your thoughts and opinions, and then promoting it all on social media. Inundated as we are with information, there is tremendous value in offering a resource that helps your audience focus their attention, and a curated selection of financial news fits the bill perfectly.

Industry reports

Post industry reports that your niche audience will appreciate. Reports like these will showcase your knowledge and build confidence in your expertise.

If you’ve niched your audience to clients who invest heavily or are in a particular industry, you have a golden opportunity to provide them with highly-focused information they otherwise may not access. Giving insights into current conditions and trends as well as potential risks and opportunities allows you to offer customized strategies and opportunities for portfolio diversification. And don’t forget that content on social media is ripe for sharing—those who read an industry analysis are likely to share it with others who have an interest in the same industry.

Interactive content

Interactive social media content appeals to users because it is engaging. Rather than passively scrolling, they can allow users to participate and be entertained, challenged, or educated, which can encourage more likes and shares. And as a business owner, you can collect data and note preferences among users, enabling you to target your marketing more precisely.

Polls and surveys

People love to share their opinions, contribute ideas, and provide feedback, makeing polls and surveys popular with both those who complete them and business owners who can cull the data for valuable information.

Q&As

A live Q&A is a highly authentic way to connect with an audience and encourage them to know, like, and trust you.

The pinnacle of interaction is live conversation, so consider hosting live or recorded Q&A sessions where you can showcase your expertise by answering inquiries from your audience. Facebook Live may be the most familiar tool to use for this purpose, but other alternatives are available. For tips on how to make the most of a live stream, check out this blog post.

Entertaining content

A well-rounded social media content strategy will not only educate your audience about securing their financial future but also entertain them. Enjoyable content increases engagement in the form of likes and shares, which can boost the visibility of your posts, help you reach a broader audience, and enhance your overall social media presence. And by providing content relevant to other aspects of your clients’ and prospects’ lives, you can connect with your audience on a more personal level and provide a wider scope of value, leading them to have a more favorable perception of you and your business.

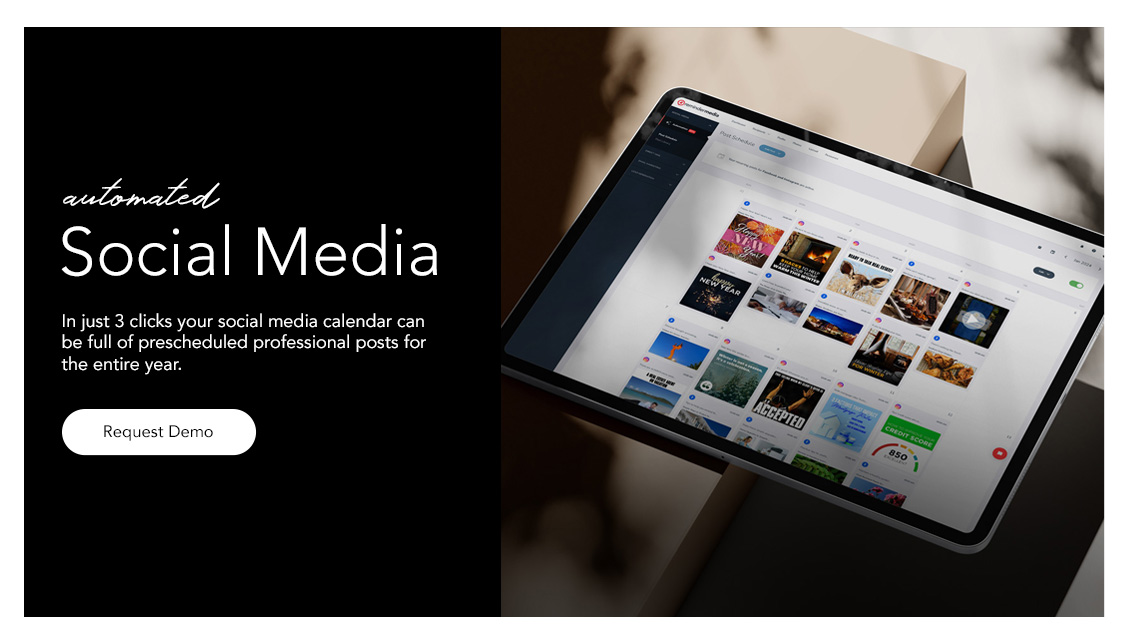

We offer a wide array of entertaining content for busy entrepreneurs who need a leg up with their social media marketing, specifically when it comes to providing value-laden content, saving time, and promoting their brand. With Branded Posts, one of four tools in our Digital Marketing Platform, you can select compliance-friendly content from our vast library and schedule posts to your Facebook and Instagram accounts weeks or months in advance using our schedulers. And because we add your photo, business name, and contact information, every post reinforces recognition of your brand and value.

Use our Branded Posts product to share compliance-friendly content that is educational and entertaining. Posts are automated and branded to you, making it easy for you to stay top of mind.

Social media marketing and management: best practices

- Engage with your audience. Don’t forget that social media is meant to be social. Be sure you respond when someone leaves a comment, not just give them a like. Connect with people who connect with you by commenting on their posts. Also find other professionals with whom you can network, then comment and share their content.

- Be authentic. On social media, audiences appreciate genuine, real-life moments so be yourself. Avoid being overly scripted, allow yourself to appear vulnerable, share personal moments, and generally forget about being perfect. Showing your true self is how people will connect with you as a human being and not just a financial professional.

- Select the right hashtags. Hashtags are used to categorize content and make it more discoverable within social media platforms. Users can search for or click on a hashtag to browse posts that have the same one. Examples relevant to finance might include #financialservices, #money, #invest, #retirement, and #personalfreedom. Consider adding your location as a hashtag such as #philadelphiaadvisor to solicit support from your local community.

- Be consistent. Developing an engaging presence on social media and a loyal following takes time, patience, and, above all, consistency. You will be better served if you post once a week for two years than if you post every day for two weeks and then stop. So create and stick to a schedule that works for you and your audience, and your followers will come to expect and look forward to your content.

- Measure and track your performance. Pay attention to metrics like engagement, reach, and click-through rates. Our Branded Posts product make this easy by tracking and displaying your key metrics right on your dashboard. Use these metrics to analyze which posts are most popular, and adjust your content strategy accordingly.

What is the best social media platform for financial advisors?

Now that you have ample ideas to fuel your social media content marketing and a good sense of what makes it effective, the next logical question is about where should you post your wonderful content.

Understand government regulations and your firm’s rules regarding use of social media and, where the opportunities exist, post to the platforms most used by your ideal client.

Simply put, the best social media platform for financial advisors is the one that allows you to remain in compliance with government regulations and your company’s rules. But as an IBD or independent RIA, you have a little more flexibility. As a joint report by LinkedIn and FTI Consulting notes, “Company policies are far more restrictive for wirehouse advisors than for either broker-dealers or registered investment advisors, which is to be expected given the greater sensitivity to regulatory implications among the larger financial institutions.”

That said, according to SmartAsset, just about 46% of advisors use LinkedIn either often or extremely often as part of their marketing while 37% use Facebook. But here’s something to consider: while advisors use LinkedIn and Facebook, Forbes Advisor found that users most trust Reddit and YouTube for financial advice. This is particularly interesting—and points to a huge opportunity for savvy IBDs and independent RIAs to put their stake in the ground—because SmartAsset’s survey reveals that nearly 80% of financial advisors claim they never use YouTube.

How financial professionals employ social media certainly varies, but IBDs and independent RIAs will be well served by posting to the platforms most visited by their target audience. HubSpot reports that:

- Gen Z and millennials rank Instagram as their favorite social media app, although Gen Z reports TikTok as their most visited.

- Gen X and baby boomers name Facebook as their favorite and most visited social media app. Baby boomers identify YouTube as their second favorite app. Gen Z, millennials, and Gen X audiences enjoy YouTube in almost equal measure.

The exceptionally large pie of social media users, and of those particularly interested in financial advice and information, can be sliced in many ways, making finding the “best” platform for marketing your services a virtual impossibility. Consider selecting one or two that offer the most promise of connecting with your ideal clients and focusing your efforts there. Provide high-quality content, remain consistent, and, with time, you will find your audience.

Final thoughts

You don’t need to be convinced that a marketing strategy using social media should be an integral part of your overall marketing plan. More likely, you need ideas about types of content that work best for financial professionals to attract prospects and convert clients and, perhaps, a way to make executing your strategy easier.

This blog gave you solid information addressing your first need. Our Digital Marketing Platform with Branded Posts is the perfect solution to your second. Visit our website or schedule a call with one of our marketing advisors to discover how effortless it is to main an active social media presence with automated, personally branded, high-quality content.