Ep. 249: 3 Ways to Stay Relevant Amid Increasing Technology (with Mike McGlothlin)

How to Stay Relevant When Technology Threatens Your Job

Who should listen: This episode is for financial advisors, real estate agents, and other small business owners wanting to know the way to long-term business success in a world of increasing DIY technologies.

Key idea: Deep knowledge of your business, providing value and building trust, and responding rather than reacting will be the keys to thriving in the face of encroaching technologies.

Action item: Add another marketing channel to educate to your clients and prospective clients.

The US economy continues to improve, with some news sources reporting it is improving faster than initially predicted and without an increase in inflation.

This is good news.

What may not be good news is the rate at which new-and-improved technologies are threatening jobs across a variety of dissimilar industries.

The fourth industrial revolution

In some parts of the world, humanity is experiencing its fourth industrial revolution. How this revolution will turn out in comparison to the previous three is a topic for debate, but it can be described as “the blurring of boundaries between the physical, digital, and biological worlds.”[1]

As a result of this revolution, Forbes suggests that millions of jobs could be lost to robots, artificial intelligence (AI), and other technology.

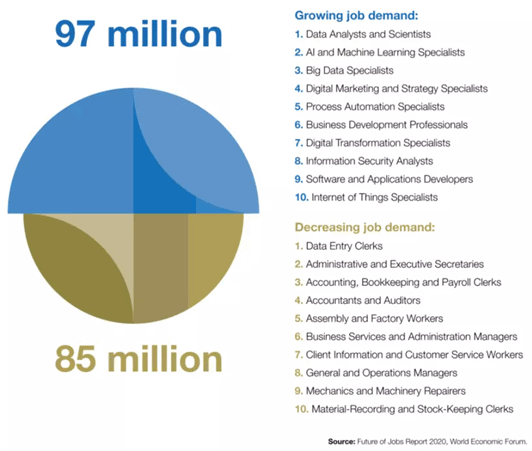

On the other hand, the World Economic Forum (WEF) explains that advancements in fields like AI will create new jobs that will surpass the number of jobs lost. The WEF goes on to argue that governments and companies will need to prepare the workforce for these new, high-tech jobs.

The World Economics Forum states that with the advent of new technologies in the fourth industrial revolution more jobs will be created than lost.

Yet where along the continuum of work—marked on one end by manual-labor jobs that robots will do, and on the other end by jobs of the fourth industrial revolution that require abstraction, data manipulation, and systems thinking—do jobs like real estate agent and financial advisor lie?

As you might imagine, the answer is somewhere in the middle.

The threat is real, but so is the opportunity

Working in the shallows, agents have certainly felt the ripples that real estate mega-databases like Zillow, Trulia, and Redfin have created. How are agents to stay relevant when technology has driven services that were once their bread and butter onto the web—where consumers on mobile devices can apply for loans, view and buy homes, and sign the dotted line, all while sipping lattes?

If you’re a financial planner, a wealth advisor, or an investment broker, then technology threatens your job too.

Ambitious and tech-savvy, the millennial generation has co-opted trading apps like Robinhood, Webull, Interactive Brokers, and other fintech to thumb their noses at Wall Street—leaving RIAs to wonder about their place in the world. Fintech and its disciples have democratized the world of finance, and, at least for a little while, funded a virtual revolution where it looked like the little guys could win.

Despite these circumstances, jobs that require developing trusting relationships with clients, such as a real estate agent and a financial advisor, are not going away any time soon. Sure, technology will change how these jobs might get done. But, ultimately, it will be human beings who presumably will use these new tools to improve those relationships.

And it’s in relationships and the customer experience that Mike McGlothlin, EVP of Retirement at Ash Brokerage and this week’s Stay Paid guest, says you’ll find at least three strategic opportunities to stay relevant.

Know your business

McGlothlin worked with Bob Knight, the former Indiana University men’s basketball coach. He explains how, when working as a student manager for Knight, McGlothlin found Knight taking a nap in the locker room a few hours before a national title game.

How, he wondered, could Knight be so calm and confident that he could sleep before one of the biggest games in his career?

It was because, McGlothlin believes, Knight knew his business better than any other coach in the league.

McGlothlin would provide the coach with video of practices and statistics about every aspect of every player and their performance. This data was only one source of information that Knight would analyze. He studied everything at his disposal to get to the point where he could predict how his team would react in every situation on the basketball court.

That deep understanding of your business—where you know your numbers and can anticipate outcomes—breeds confidence.

A high level of justifiable confidence builds your clients’ and prospects’ trust in you. Your knowledge of your business may be your clients’ most important criterion when deciding whether to trust you with the single biggest purchase of their lives or with securing their financial futures.

Collectively, we still have a latent distrust of technology we don’t understand. It’s human nature to be wary of what we don’t know. Even patients who turn their lives over to robotic machines that perform delicate surgery do so only when a doctor they trust has told them it’ll be okay.

If you want to stay relevant when technology threatens your job, make sure you know your business better than anyone else.

Provide value on every channel

Value will always be relevant.

A recently published e-book about trends in consumer behavior reports that consumers place more importance on value than on cost. (Check out episode 246 for tips about to use recent consumer trends to your advantage.)This is good news for professionals who can use value-based pricing strategies and justify the cost by providing an outstanding customer experience.

One surefire way to provide value and enhance the customer experience is to offer clients and prospective clients information that they can use when and where they want.

We’re only now beginning to emerge from the COVID-19 pandemic, but, in 2020, financial advisors who relied on in-person seminars to educate clients and generate leads were hit hard.

Not long ago, Brad Swineheart, the VP of Business Development at White Glove, spoke with us about how his business had to pivot from seminars held in restaurants and hotel conference rooms to virtual webinars. It turned out to be a blessing in disguise. Virtual seminars are now a major part of their business.

One reason for White Glove’s success is that, while it still provided the same level and quality of service, its clients were now able to reach their clients and prospects in the places and at the times their clients found convenient. Not surprising, McGlothlin made the same observation—but he took it one step further.

To stay relevant, he advises agents, advisors, and others whose jobs may be threatened by technology to add services that create a customer experience that delivers excellence, consistency, empathy, appreciation, and value across all channels.

Adapt and respond to changes

Building trust and offering an extraordinary customer experience supported with value are two strategies you can use to stay relevant when technology threatens your job,

A third strategy is to competently respond rather than react to changes in your industry.

Speaking about the situation facing financial advisors, McGlothlin notes that an unprecedented shift in US demographics and changing economic conditions have made planning for continuous income after retirement an imperative. His point is that adding services like income planning not only adds value to the client experience but also will help advisors stay relevant and allow for value-based pricing.

Unfortunately, he says, not all advisors have caught on to this idea—leaving their clients’ futures and their own relevance at risk.

We could say the same about what’s happening in the real estate market.

Agents have had to adapt to an incredibly strong seller’s market. In large part, an agent’s value today is derived from confidently being able to coach clients through an unusually arduous home-buying process.

Real estate agents are being confronted with possibly having to advise clients to settle for the best houses they can find rather than stay in continuous pursuit of what they want—a disappointing message to have to deliver.

Many times, they’re also challenged with needing to prepare their clients for the stress of an expensive bidding war and having creative strategies for how to win.

And there are occasions in this market when clients may be willing to pay far more for a house than it’s worth. That’s when an agent will act in their clients’ best interests and steer them toward a more reasonable action.

These are all instances where trust will rule the day.

An agent who has strong relationships with their clients, who has an expert understanding of how the market is operating and the impact for their clients, and who has strategies that will work in their clients’ best interests, will win against handheld technology every time.

The same holds true for any correlating profession where the human element is integral to the business at hand.

And this is good news because, being human, we can continuously improve that part of the customer experience. All it takes is the will to do it and, perhaps, a few cool tools.

__________________________

[1] Devon McGinnis, “What Is the Fourth Industrial Revolution?” SalesForce, October 27, 2020, www.salesforce.com/blog/what-is-the-fourth-industrial-revolution-4ir/.

Connect | Resources

Free resource: Small Business Podcasting: The Ultimate Starter’s Guide at remindermedia.com/podcasting

Website: highperformingpractice.com

Podcast on Apple Podcasts: The High Performing Practice

Book: Winning Strategies: The New Rules of Retirement Planning

Book: Above the Clouds . . . Winning Strategies from 30,000 Feet

Book: Free Throws for Financial Professionals: Winning Principles for Unlocking Business Success

We are a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for ReminderMedia to earn a small fee by linking to Amazon.com and affiliated sites

Soundcloud

Soundcloud iHeart Radio

iHeart Radio Spotify

Spotify Spotify

Spotify