I’m just going to come right out and say it . . . Zillow has a trust issue.

Trust is one of the most fragile of all emotional states because it relies on other people to behave in expected ways, and it’s easy for people to mess with our expectations. When we trust someone, we expect them to act with integrity, and we’re confident in their honesty.

On more than one occasion, Zillow has violated a collective set of expectations among real estate professionals and all but destroyed any confidence in their honesty. As a result, there is a growing perception that the Zillow brand is not to be trusted.

Case in point—Zestimates

Agents have long had an issue with the accuracy of Zillow’s home price estimates. In larger markets, the median error is about 2% between the estimates delivered by Zillow’s automated home valuation tool and the actual sale price of homes—not too bad.

However, when their estimates are wrong, they can be substantially wrong.

If you look at the various metro areas where estimates are provided, Zillow might be within 5% of the actual sale price only 62% of the time. Agents trying to explain to prospects in the other 38% that their homes aren’t worth what Zillow says they’re worth, and that the estimates they’re seeing on the internet aren’t accurate, have undoubtedly lost clients. (“But it’s got to be accurate. It’s on the internet!”)

Zillow is careful to state on their website that their estimates are just that—estimates—and not appraisals, and should only be used as a “starting point”:

We encourage buyers, sellers[,] and homeowners to supplement the Zestimate with other research such as visiting the home, getting a professional appraisal of the home, or requesting a comparative market analysis (CMA) from a real estate agent.

Try as Zillow might to cover its proverbial butt, we all know that people are selective in what they pay attention to, and, once they’ve formed an opinion, the facts don’t always matter. And battles between actual home values and what homeowners believe their homes should be worth happen often enough that the growing consensus is Zestimates can’t be trusted.

Where there’s smoke, there’s fire

Another sign that Zillow has a trust issue is what’s happening in the courts.

I’m making no accusations, nor am I drawing any conclusions about any potential culpability Zillow may own as it faces an antitrust lawsuit from the technology-based real estate broker Real Estate Exchange based in Austin, Texas. Similarly, I’m withholding all opinions about the Federal Trade Commission’s reopening of Zillow’s purchase of ShowingTime.

What I am claiming is not all publicity is good publicity.

The mere fact that Zillow is in the unenviable position of having to defend itself in a court of law means it’s also squarely sitting in the court of public opinion—and, historically, the latter isn’t as concerned about the facts. For many, suspicion alone (especially if the media decides a story is “newsworthy”) is enough reason to withhold their trust.

Karma’s a . . .

Then there’s the current debacle.

After promising it would not compete with agents, in December 2019, Zillow began to connect buyers and sellers directly—bypassing agents and essentially taking on the role of a broker.

Zillow launched their iBuyer program and began offering homeowners fast, cash deals for their homes. In exchange, sellers would pay what was essentially a commission fee, and they didn’t need to worry about a drawn-out bidding, sales, and closing processes. They also didn’t need to be concerned about costly repairs since Zillow would take on minor repairs and quickly flip the houses for a small profit. The goal was to make money by emphasizing the number of homes sold rather than selling fewer homes at higher prices.

Then the conspiracy theories began popping up.

At least one agent, Sean Gotcher, began accusing iBuyers of manipulating home prices in his neighborhoods. Zillow, Redfin, and other iBuyers responded.

Redfin CEO Glenn Kelman said Gotcher’s description of iBuying “is untrue,” and Redfin would “never intentionally underpay or overpay for a home.” For its part, Zillow sent an email to Inman characterizing Gotcher’s Twitter video as an example of “misinformation and falsehoods” and added, “We pay market value for every home we purchase.”

Regardless, once the toothpaste is out of the tube, you can’t put it back in. As I write this blog, Gotcher’s video has 2.2M views, 34.1K likes, and 9,888 retweets.

Only a few months ago, in August, Zillow officials cited Q2 financial documents as evidence that their iBuyer program was doing well and was a notable part of their overall business. They spoke of buying large numbers of houses as proof that the data and algorithms they used to price homes and make subsequent offers were beneficial to sellers. They also announced the company had secured a $450M loan to continue growing Zillow Offers.

Then, on October 18, in a sudden move, Zillow announced it would stop buying houses for the rest of 2021, referring to the unpredictable availability of supplies and labor, a competitive real estate market, and the need to unload a backlog of properties.

In the wake of Q3 losses, Zillow stated on Tuesday that it was exiting the home-buyer market and releasing 25%, or about 2,000, employees. The rest of the story is quickly becoming history . . .

Lessons for real estate agents

There are 3 exceptionally significant lessons to be learned from Zillow’s example.

Don’t ever assume that your brand is what you say it is

A brand is, and always will be, the culmination of people’s perceptions (accurate or not) of you and your business. Zillow may claim to be the leading real estate and rental marketplace but, if, as I suspect, there is a growing consensus that Zillow is not to be trusted, then Zillow becomes the brand not to be trusted.

There will never be an adequate substitute for local agents who know their market

Year over year, homes prices are up about 20% and yet, as Mike “Mish” Shedlock of Mish Talk observes, “Zillow managed to lose money flipping homes.”

How did that happen?!

CNBC reports that after the November 2 interview on Closing Bell, Zillow’s CEO, Rich Burton, said “Zillow’s ultimate failure was its inability to predict housing prices accurately.” Translation: Zillow’s estimates on the value of the homes they purchased were wrong.

I’ve never come across a better example of irony.

As you know, local agents are the boots on the ground; you’ve got street cred. You have the most thorough and reliable information about the market, including what houses are selling for, where, and why. No algorithm is going to be able to predict what you already know. Use this knowledge to your advantage.

Trust is your most valuable business asset

Glennda Baker, an agent in Atlanta, Georgia, has a much more critical and credible view of Zillow’s supposed $500M loss. Glennda was a founding member of the Zillow advisory board. She worked with a group of 20 agents to help develop Zillow’s consumer experience back when they thought Zillow would work for the benefit of consumers and agents.

In a recently released Instagram Reel, which I highly suggest you watch, Glennda asks a very basic question:

If you were a seller, would you trust a company that lost 500 million dollars on their own purchases of real estate? So, what they were willing to pay, what they thought was the true value of real estate, they’re going to lose 500 MILLION dollars. Let’s just take a moment . . . would you trust that person’s opinion of [the] value of your home?

The reason I’m recommending that you watch Glennda’s video is she emphatically calls into question Zillow’s true motive for shutting down Zillow Offers and casts a wide net of suspicion and distrust. In my opinion, her comments have stirred the pot enough to have every antitrust lawyer frothing at the mouth and every American homeowner shouting at the top of their lungs for justice.

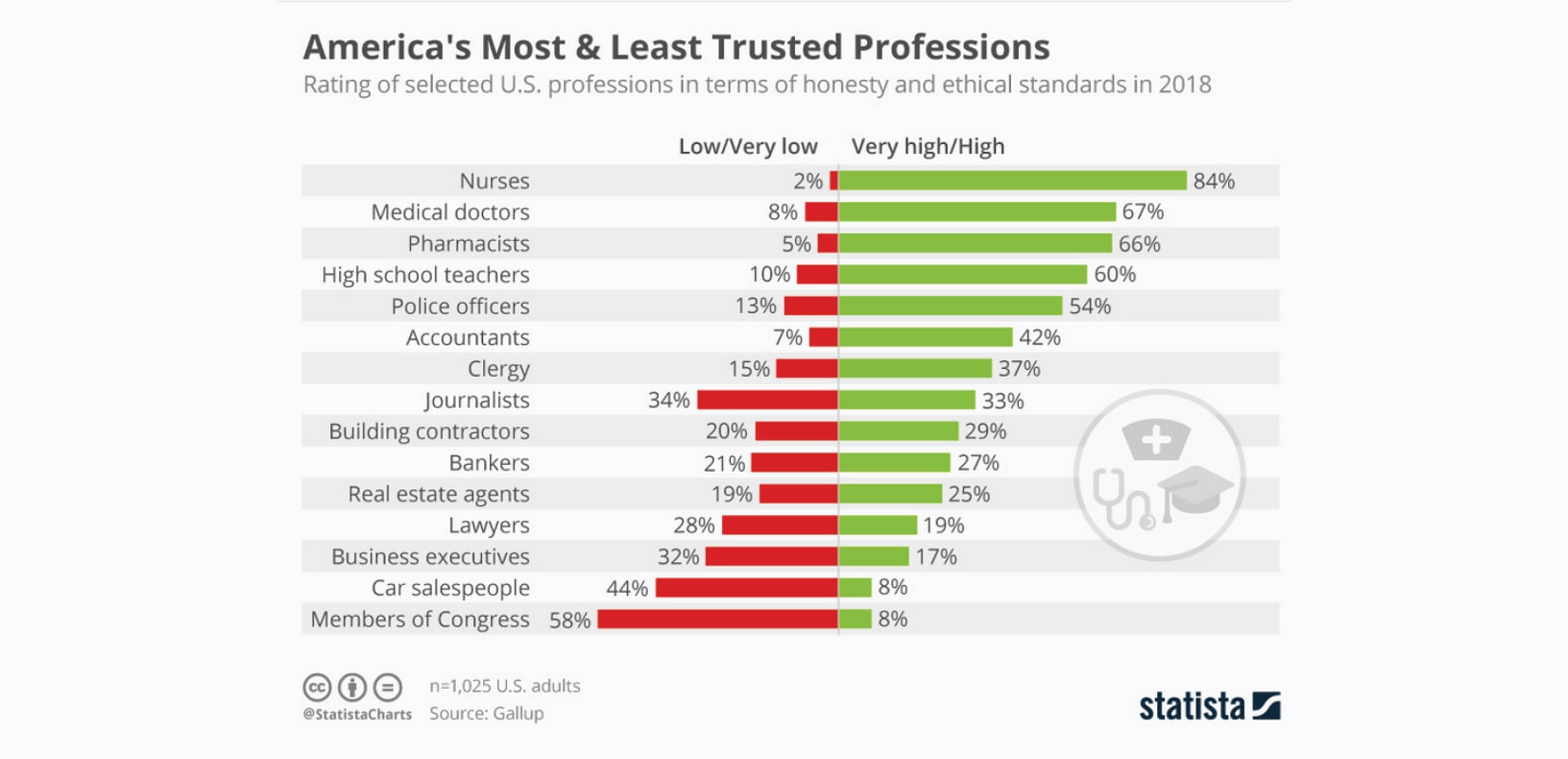

It’s little wonder why real estate agents are so poorly trusted. A 2018 Gallup poll asked Americans to rank 15 professions for trustworthiness. In a case of guilt by association (megabrokers have been eyed with suspicion since their inception), real estate agents were among the least trusted professionals, coming in at 11. (Gallup’s 2020 poll did not include real estate agents among its choices.)

Before prospects will do business with you, they must first know, like, and trust you. Without that final component, you’ll never convert them to clients.

Building trust takes time, and over time you need to become familiar and demonstrate consistent action.

- If you say you will call with information, then you need to call—even if it is to tell your prospective client that you haven’t forgotten them and are still working to get what they need.

- You must be on time for appointments.

- You must be available when you say you will be available.

- You must look out for their best interests, not your own.

- You must be honest.

These are all fundamental of the business; it’s almost insulting for me to bring them up—almost. The truth is not all agents adhere to the basics.

We’ve designed products to help you become the recognized and trusted real estate expert in your market. If you need help developing trusted relationships with the people in your database, then check us out. Watch our free video, and get a free copy of our most recent personally branded magazine. We can help prospects view you as the agent of trust.

Apple Podcasts

Apple Podcasts

Google Play

Google Play

Spotify

Spotify